What the RBI’s 50-Point Rate Cut Means for India’s Growth: Experts Weigh In

In a decisive move to boost economic growth, the Reserve Bank of India (RBI) has slashed the repo rate by 50 basis points, bringing it down to 5.50%. This is the third consecutive rate cut by the central bank in 2025, totaling a full percentage point reduction since February. Alongside this, the Monetary Policy Committee (MPC) has shifted its stance from ‘Accommodative’ to ‘Neutral’, signaling a more balanced and data-driven approach to monetary policy.

But that’s not all—the RBI has also reduced the Cash Reserve Ratio (CRR) from 4% to 3%. This move injects fresh liquidity into the banking system, giving banks more flexibility to lend and making it easier for businesses and individuals to access loans at lower interest rates.

Why Did the RBI Cut Rates Now?

The timing of these changes is crucial. Inflation in India is currently well under control—the Consumer Price Index (CPI) for April 2025 came in at just 3.2%, the lowest in nearly six years. Retail inflation is also at a historic low of 3.16%. With price pressures easing, the RBI now has room to focus on stimulating domestic demand, private investment, and overall economic expansion.

How Market Experts View the RBI’s Growth-Focused Policy

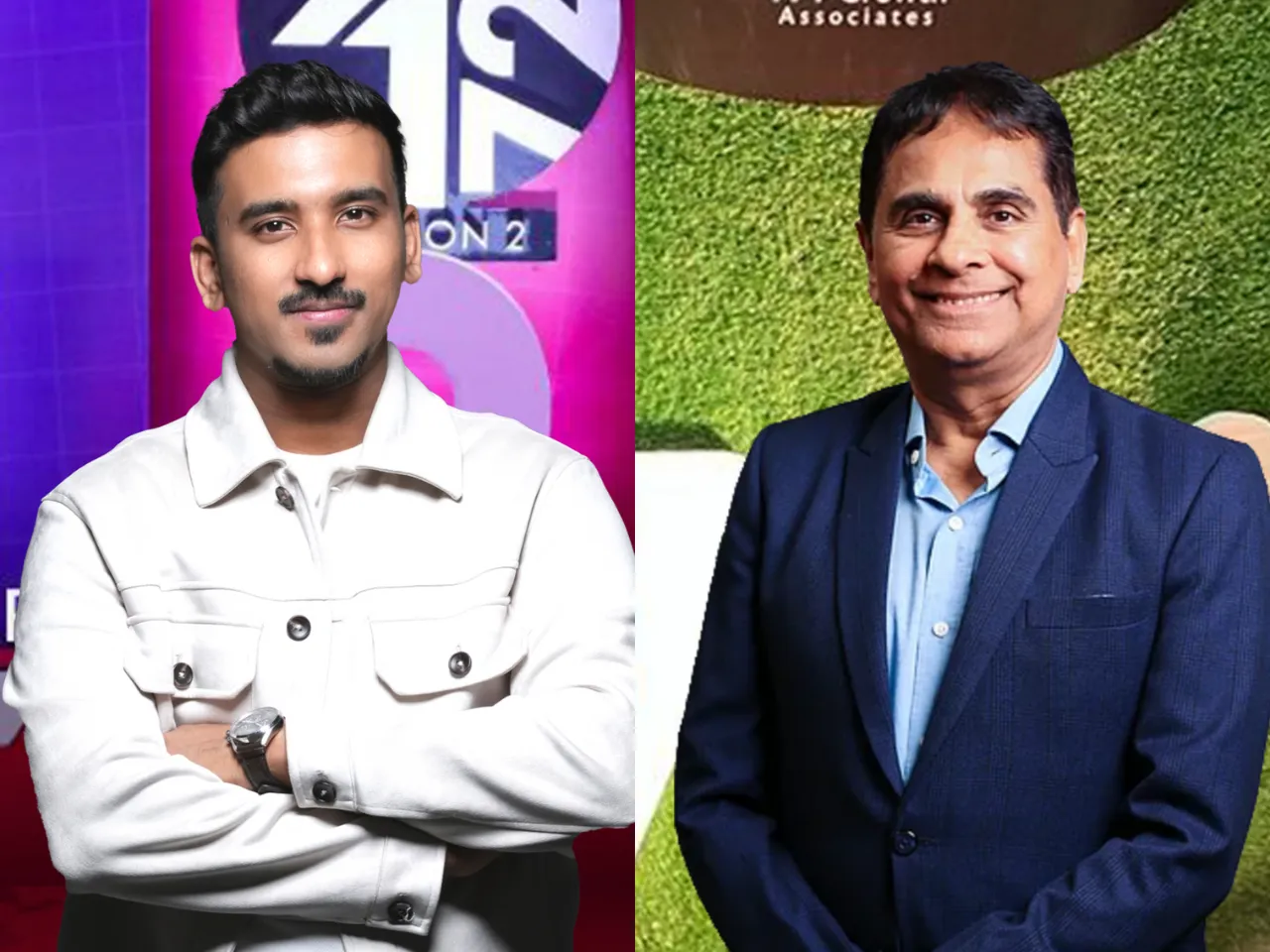

Ashwani Dhanawat, Executive Director and Chief Investment Officer at Shriram General Insurance, believes the combination of the repo rate cut and CRR reduction highlights the RBI’s commitment to supporting economic growth. According to Dhanawat, these measures will likely boost credit flow, encourage borrowing, and drive business activity across key sectors. He points out that with inflation low, consumers may feel more confident, leading to higher demand for financial services, insurance, and other products as the economy picks up steam.

Vijay Kuppa, CEO of InCred Money, agrees that inflation is no longer the central bank’s main concern. He credits the moderation in food and fuel prices, a strong rabi harvest, and an early monsoon for allowing the RBI to lower its FY26 inflation forecast to 3.7%. While the RBI has kept its FY26 GDP growth projection steady at 6.5%, Kuppa emphasizes the urgent need to stimulate private consumption and capital formation. He also notes that the CRR cut, combined with the repo rate reduction, will help banks pass on lower rates to borrowers more effectively, potentially sparking both business investment and consumer spending.

What’s Next for Borrowers and Investors?

With the MPC’s shift to a ‘Neutral’ stance, further rate cuts are unlikely in the near term. Future monetary policy decisions will depend on global trade trends and commodity prices. For now, borrowers can look forward to lower EMIs and reduced borrowing costs, while investors may want to lock in fixed deposit rates before they fall further. Despite some market volatility, experts see new opportunities emerging in both debt and equity markets as India enters a lower interest rate environment.

The Bottom Line: RBI’s Policy Shift Sets the Stage for Growth

The RBI’s coordinated actions—cutting the repo rate, reducing the CRR, and adopting a more neutral policy stance—reflect a timely and strategic effort to energize the Indian economy. With inflation under control and liquidity on the rise, these reforms are expected to stimulate demand, accelerate the credit cycle, and attract new investments. As India navigates global economic uncertainties, the central bank’s growth-focused measures position the country for sustained momentum and long-term resilience.